创造历史!创指点位首次超越沪指!透露什么信号?

2021年7月9日,根据联合国责任投资原则组织(United Nations Principles for Responsible Investment,以下简称“UNPRI”)官网公布,华泰证券(上海)资产管理有限公司(以下简称“华泰证券资管”)已正式签署协议加入UNPRI。

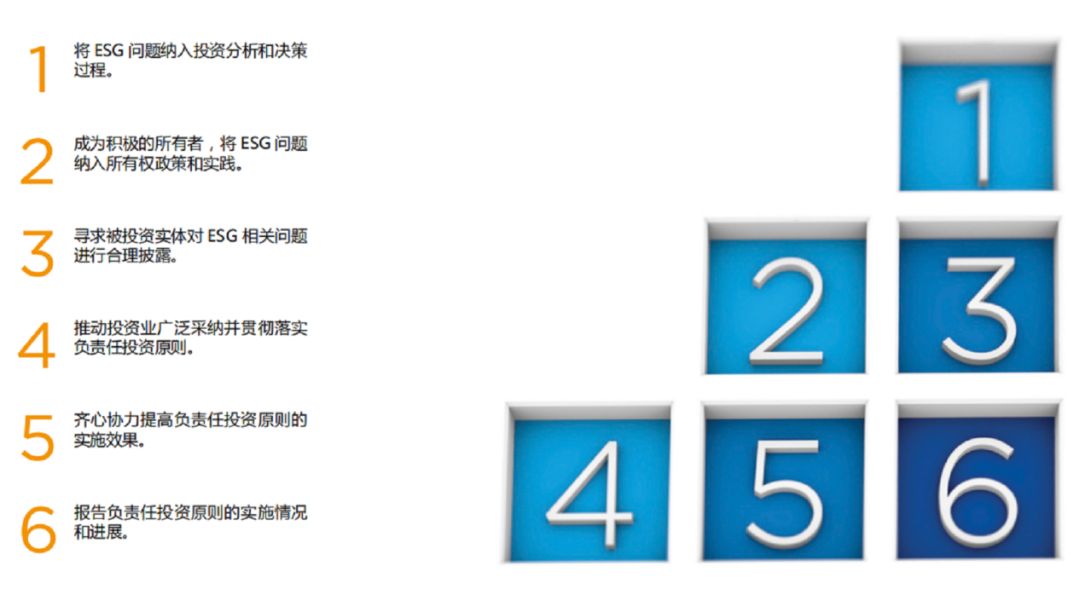

UNPRI由联合国前秘书长安南于2006年牵头发起,旨在帮助投资者理解环境、社会和公司治理等要素对投资价值的影响,并支持各签署机构将这些要素融入投资战略与决策中。此次正式加入UNPRI后,华泰证券资管成为中国加入该组织资管规模最大的券商资管子公司,标志着华泰证券资管将承诺遵循UNPRI的六大原则,继续践行责任投资的理念,为广大投资者提供更优质的服务。

UNPRI六大原则,来源:UNPRI官网《中国市场的ESG与Alpha》报告

近年来,华泰证券资管积极践行零售业务和机构业务“双轮驱动”战略,截至2020年底,华泰证券资管管理规模近6000亿元人民币,保持着业内领先的投资管理能力和投资业绩。华泰证券资管在经营发展与业务层面深入ESG理念,推出多项绿色ABS项目,其中大多为行业首创,涉及水电、固体废弃物处理、新能源、碳中和、绿色经济等领域,匹配社会责任投资特性,为实体企业提供了快速、大量、长期、稳定的资金支持。

近年来,华泰证券资管身体力行,通过追求长期性、价值性的投资,促进实现经济效益与环境效益、社会效益、治理效应(ESG,Environment、Social、Governance)的统一。华泰证券资管积极探索服务实体经济新模式,勇担国民责任,积极发行疫情防控ABS用于疫情地区的工程设备租赁,为疫情防控所需的工程设备租赁提供了高效、低成本的金融支持;顺利实现为龙头民族品牌提供金融支持赋能“中国制造2025”及“服务实体经济”等国家战略,推动国内高端装备制造行业的长效发展。同时积极发力新能源产业,最大化发挥资产证券化盘活存量资产的效能,为某风电为主营业务发电企业提供融资渠道,项目储架规模超百亿元,为新能源公司进一步发展提供了新的思路,树立了行业标杆。

此次华泰证券资管在国内同业中率先加入UNPRI,将在其六项责任投资原则指导下构建ESG投研框架、开展ESG与投资体系的整合,同时开发ESG相关投资产品,以期更全面的管理投资风险,发掘对环境和社会能产生长期积极影响的投资机会,增强可持续的长期投资回报。

绿色发展已逐步成为全球共识,“碳达峰、碳中和”目标已正式上升到国家战略层面。华泰证券资管将致力成为有益于经济和社会发展、注重环境保护的优秀企业,在中国经济结构、能源结构、产业结构面临深度低碳转型的进程中,身体力行践行责任投资,以专业能力和绿色经营理念发挥出持久的驱动力和生命力。公司将持续主动发力责任投资领域,在投、融资两端双向赋能责任投资,创新ESG产品和绿色资管产品,全面联动助力绿色金融、赋能责任投资生态,以更强的责任感和使命感及专业、高效、优质的服务,为经济效益与环境效益、社会效益、治理效应可持续发展注入更多力量。

On July 9th, 2021, according to the announcement from the United Nations Principles for Responsible Investment (‘UNPRI’), Huatai Securities (Shanghai) Asset Management Co., Ltd. (‘HTSCAM’or ‘the Company’) has officially signed the agreement to join the UNPRI.

Led by former Secretary-General Kofi Atta Annan in 2006, UNPRI aims to help investors comprehend the significance of environmental, social, and governing factors on the value of investments. Moreover, UNPRI supports its signatories to integrate those factors into their investment processes and strategies. After officially becoming a signatory, HTSCAM has become China's largest asset management subsidiary of an investment bank to join the organization and will be committed to abiding by the Six Principles of the UNPRI, continue to apply the concept of responsible investment, and provide better services for the vast majority of investors.

In recent years, the company has actively practiced a ‘two-pronged’ development strategy of wealth management and institutional services, and its average annualized return on investment has taken a lead in the industry and produced excellent outcomes. By the end of 2020, HTSCAM’s AUM exceeded over RMB600 billion. The Company always highlights the concept of responsible investment and devoted its efforts concerning responsible investment. For example, the introduction of several green ABS projects, most of which are industry-first, involves fields such as hydropower, solid waste treatment, alternative energy, carbon neutrality, and a green economy, etc. Those products aim at matching the characteristics of socially responsible investment and providing enterprises with on-demand, long-term, and stable financial supports.

Over the recent years, we have been diligently focusing on investment opportunities that provide long-term perspectives and benefits. Our main focus is to promote the unification of economic benefits, social benefits, and environmental benefits. HTSCAM is actively involved in exploring new business models to better serve the real economy. On the one hand, the Company bore the critical responsibility to issue the COVID-19-designated ABS, which was used in providing leases for equipment needed in regions that were affected by the pandemic. This issuance provided highly efficient, low-cost financial supports for equipment leases required for controlling the pandemic, while also enabled the industry national leaders such as HTSCAM to put key national strategies such as ‘Made in China 2025’and ‘Serve the Real Economy’ into practice and promoted the long-term development of high-tech equipment manufacturing industry in China. On the other hand, the Company actively seeks opportunities in alternative energy solutions. To maximize the effectiveness of securitization, which leverages the underlying assets, the Company supported raising over RMB10 billion in funding for an enterprise whose core business is wind power generation. This industry-leading example has provided new strategic pin-points for alternative energy providers with funding requirements.

HTSCAM is one of the first domestic players in the industry to join the UNPRI. Under the Six Principles of the Responsible Investments, we will build the ESG Investment Committee, draft the ESG Investment Research Framework, carry out the integration of ESG factors with investment processes, as well as develop ESG-related products. We hope to apply a holistic approach to manage investment risk, explore investment opportunities that have long-term positive effects on the environment and society, and improve long-term returns for the investors.

The concept of green growth has become a global consensus, and targets such as ‘Peak Carbon-Dioxide Emission’ and ‘Carbon Neutrality’ have become key national strategies. HTSCAM will aim to become a reputable enterprise that benefits social and economic development. Under the big picture of China’s transition toward a low-greenhouse-gas-emission social, energy, and economic structure, the Company will also practice responsible investing by strengthening its expertise in and understanding of green operations, which eventually becomes a driving force that leads to long-term prosperity. Looking ahead, HTSCAM will continue to actively engage in responsible investing through the two-way driver of investing and financing. Our approaches include innovating in and providing a persified list of ESG products, linking and fueling the Green Finance, and empowering the responsible investing ecosystem. Our mission: To bring vitality into social, economic, and environmental benefits by shouldering more responsibilities, and providing services that possess professionalism, efficiency, and high quality.